3D Secure

Overview

This page offers a complete collection of guides and tutorials about 3D Secure in the PayConex™ API. It includes an introduction to the 3D Secure protocol, detailed explanations of its benefits, and step-by-step instructions on how to configure and use it effectively within the PayConex™ system. Whether you're new to 3D Secure or looking for advanced implementation details, this resource has everything you need to get started.

As 3DS falls into the category of Fraud Prevention, we recommend reading up on:

3DS Protocol

3D Secure (3DS) is a protocol that adds a layer of security to prevent fraud in eCommerce transactions with credit & debit cards. It sits on the merchant's payment form and authenticates customers in real-time during card not present transactions.

FAQ: Can 3D Secure help in lowering interchange rates?

3-D Secure qualifies transactions as "less risky" on a network level - enabling Visa and Mastercard to offer lower interchange rates on reward cards.

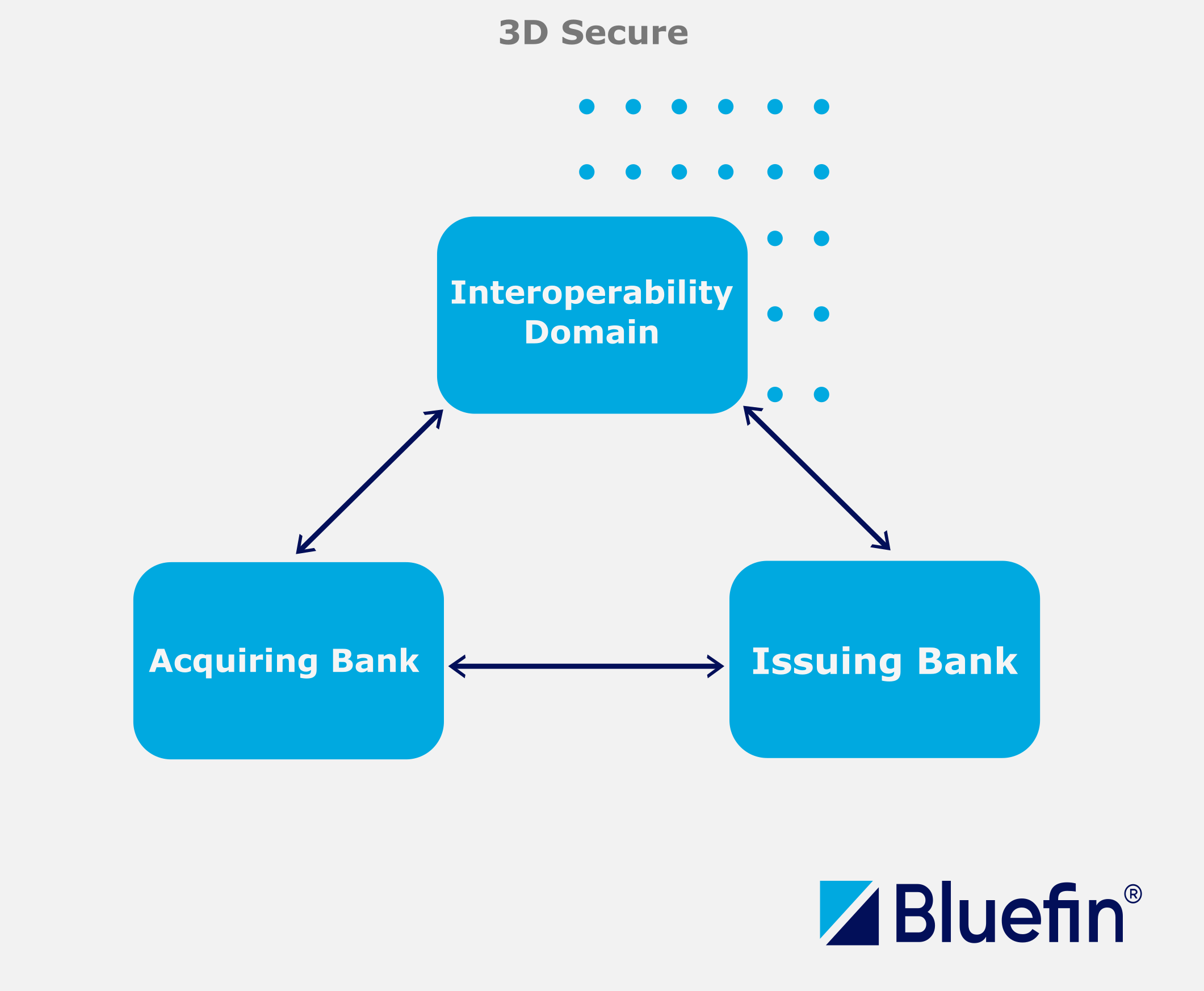

"3D" refers to the "three domains" involved in the protocol's interaction:

- Interoperability domain: The payment system or gateway between the other domains

- Merchant/acquirer domain: The environment for the merchant’s or acquirer's processing

- Issuer domain: The cardholder's bank or issuer's environment

Here is an illustration of the relationship of these three domains combined.

3D Secure Domains

For more information on the 3DS Protocol in more depth, refer to EMV® 3-D Secure.

3D Secure Workflow

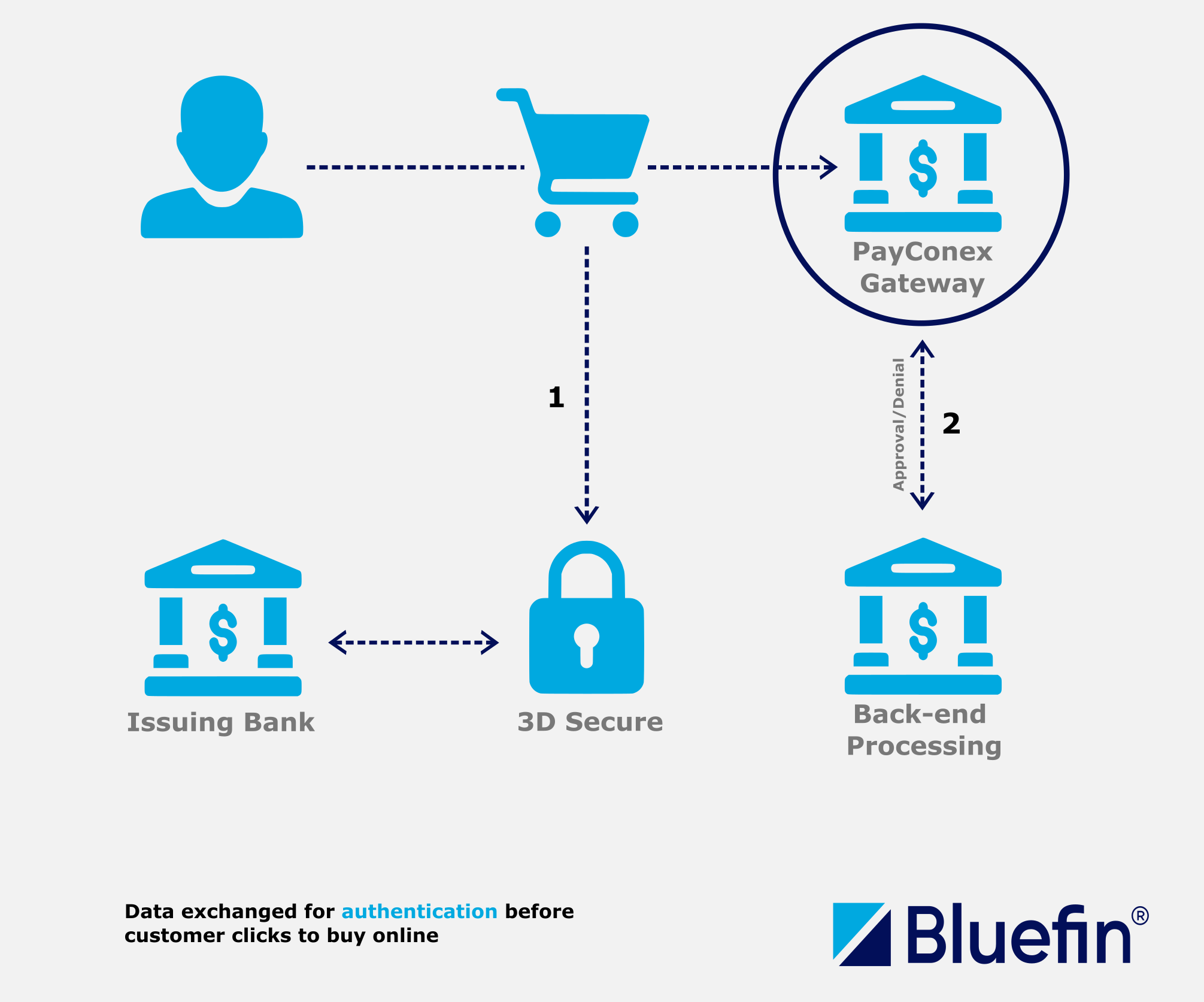

The complete 3D Secure workflow is divided into two main iterations:

-

3DS Authentication with the issuing bank driven by a 3DS service

-

Authorization of payment with 3DS data

3D Secure sits on the merchant's payment form and allows the acquiring bank to verify the cardholder's identity with the issuing bank. The authentication happens within milliseconds behind the scenes and starts as soon as the cardholder finishes typing their information. The authentication is completed without further shopper interaction. All of this occurs in the browser environment.

FAQ: When does the authentication Happen?

The authentication starts as soon as the customer finishes entering their credit card information on the merchant payment form prior to the customer hitting submit. If the transaction is authenticated the merchant will receive 3DS data that is then passed to the gateway and finally to the processor. There is no impact on the customer experience, everything happens on the back-end. After you enter your credit card information, you will see the authentication happen. Note that your credit card won't be charged as this can be done in the certification environment. For more on that, see 3D Secure Merchant Plug-In.

This workflow can be depicted in the following diagram:

3D Secure Workflow

-

3D Secure Service: After successful authentication with the card network and the issuing bank, the 3DS data results are appended to the payment request.

-

Authorization of payment: If the issuing bank approves authorization, the transaction proceeds to settlement with the payment processor and acquiring bank (back-end processing).

- If authentication has previously failed, the 3DS data is stripped from the meta-data, and the transaction is not considered 3DS-Authenticated. The handling of transactions with failed 3DS data—whether they are blocked or processed—depends on the business rules and configuration of the payment gateway or acquirer, varying based on the strictness of a system setup. As a secondary line of defense when 3DS fails, Anti Fraud Scoring is also typically used.

FAQ: Who is Bluefin’s 3D Secure service?

Bluefin utilizes its own proprietary 3DS Solution, designed in compliance with the EMV® 3-D Secure Protocol and Core Functions Specification certified for Visa, Mastercard, Discover and AMEX. This solution is fully integrated into the PayConex™ System, ensuring that all PayConex™ users are automatically supported with 3D Secure functionality. It ensures a smooth user experience while maintaining high security standards.

Bluefin 3DS Solution can be simulated via 3DS MPI in the certification environment for testing purposes.

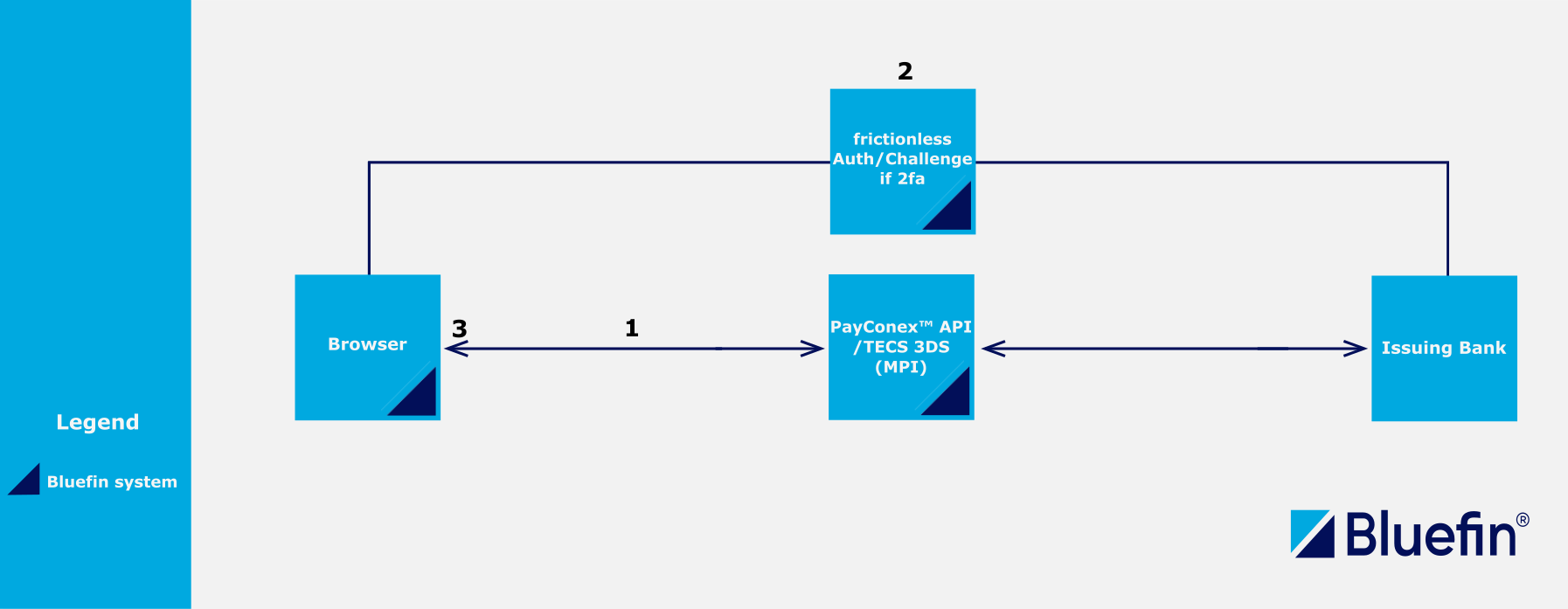

Bluefin 3DS Workflow

As outlined in the 3D Secure Workflow, the Bluefin 3DS service manages the 3DS authentication. This is summarized in the following key points.

-

Browser-to-3D Secure Communication: Forms the real-time link that verifies the cardholder.

-

Data Generation: The Bluefin 3DS service creates and returns

ddds_*parameters for the subsequent transaction. -

Universal Application: This applies to the iFrame, Hosted Payment Forms, and Server-Side Integration or Client-Side integration(3DS SDK) - especially for large ISVs with their own PCI-compliant environments.

-

ISV Use Case: Large ISVs with their own PCI-compliant environment can integrate directly with Bluefin 3DS via client-side or server-side approach.

PayConex™ Integration with Bluefin 3DS Solution

Note

This workflow can be simulated via 3DS MPI in the certification environment for testing purposes.

- Challenge Initiation: Once the customer fills out the initial form (with 3DS enabled), Bluefin 3DS sends a request to the issuing bank to initiate a challenge. At this point, the communication bridge between the issuing bank and the browser is established.

- Challenge Completion: Based on the chosen challenge indicator, a challenge is presented to the customer for completion.

- 3DS Data: After the challenge is successfully completed, the PayConex™ API returns all of the

ddds_*data parameters necessary for a subsequent transaction request such as a sale, authorization, store, etc. These are then reused to either composeeTokenvia theiFrameencrypt function or are provided directly in a transaction API request.

FAQ: What data elements are passed to authenticate a cardholder?

For 3DS authentication, the following data elements are passed to the issuing bank’s Access Control Server (ACS): 16-digit card number, expiration date, CVV, browser URL or app URL, IP address, and device fingerprinting data.

Access Control Server (ACS) refers to the issuing bank’s software that authenticates e-commerce transactions through the 3D Secure network.

3D Secure Merchant Plug-In

Our Bluefin 3D Secure Merchant Plug-In (MPI) is used in both testing and production environments, but its purpose and setup may vary:

- Testing Environment:

- In the testing or certification phase, the MPI typically interacts with test systems, such as a simulator for the Access Control Server (ACS). This allows merchants and developers to validate their integration without involving real-world transactions. Test cards and mock responses are used to simulate various scenarios, including successful authentication, challenge flows, and errors.

- Production Environment:

- In production, the MPI handles live transactions, interacting with the actual ACS and directory servers of card networks (e.g., Visa, Mastercard). Its role here is to facilitate cardholder authentication and ensure compliance with 3DS protocols for secure payment processing.

Did you know?

This 3DS solution is also integrated in the Bluefin TECS Web for all kinds of transactions including MITs, CITs, and COF transactions. To compare the PayConex™ system and TECS Web integrations, check out TECS 3D Secure Transaction.

Chargeback Reason Codes

In the back-end, authenticated transactions receive a chargeback liability shift and go straight to the issuer. Here is a brief table of fraud chargeback codes. As there are various types of chargeback reason codes, check out the following comprehensive documents:

- Mastercard

- Visa

FAQ: Does 3D Secure completely prevent chargebacks?

The answer is both "yes" and "no" because it depends on the chargeback reason code.

3D Secure can reduce certain fraud chargebacks and "friendly fraud" such as:

4837- No Cardholder Authorization4849- Questionable Merchant Activity4863- Cardholder Does Not Recognize - Potential FraudFor more reason codes, check out Chargeback Reason Codes.

3D Secure alone will not eliminate all chargebacks.

FAQ: What is "friendly fraud"?

"Friendly fraud" refers to a legitimate purchase made by a consumer with their credit card which is later disputed with the issuing bank rather than requesting an exchange or refund from the merchant. It can be malicious, but more often, there is a misunderstanding. Friendly fraud can account for 40% - 80% of all fraud losses.

Mastercard Fraud Chargeback Reason Codes

| Reason Code | Description |

|---|---|

4837 | No Cardholder Authorization |

4840 | Fraudulent Processing of Transactions |

4849 | Questionable Merchant Activity |

4863 | Cardholder Does Not Recognize - Potential Fraud |

4870 | Chip Liability Shift |

4871 | Chip Liability Shift-Lost/Stolen/Never Received Issue (NRI) Fraud |

Visa Fraud Chargeback Reason Codes

| Reason Code | Description |

|---|---|

57 | Fraudulent Multiple Transactions |

62 | Counterfeit Transaction |

81 | Card-Present Environment |

83 | Card-Absent Environment |

93 | Visa Fraud Monitoring Program: Merchant Fraud Performance Program, which does not apply in the U.S. |

10.1 | EMV Liabilty Shift Counterfeit Fraud |

10.2 | EMV Liabilty Shift Non-Counterfeit Fraud |

10.3 | Other Fraud - Card-Present Environment/Condition |

10.4 | Other Fraud - Card-Absent Environment |

10.5 | Visa Fraud Monitoring Program |

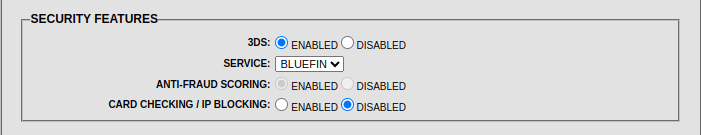

Requirements

The user must enable the 3D Secure option in the PayConex™ Portal settings, under the Security Features section, using our Bluefin 3DS solution as the 3DS service. In the PayConex™ Portal, this service is labeled and referred to as BLUEFIN, as shown in the example below.

PayConex™ Portal Security Features

Note

The Bluefin Administrators must first enable this security feature for all three implementation options to support 3DS. If you do not see it in the Settings, please reach out to the Bluefin Technical Team for assistance.

Anti-Fraud Scoring is also enabled by the Bluefin Administrators. For the complete guide, check out Fraud Scoring.

3DS Data Parameters

The 3DS data parameters, prefixed with ddds_*, are required in the transaction request for a successful 3DS transaction. The second 3DS iteration for the payment request adds these parameters as transaction meta-data.

| Parameter | Type | Description | Example |

|---|---|---|---|

ddds_version | string | The version of the 3D Secure (3DS) protocol used in a transaction. 3DS 2.0 offers improved user experience and additional features such as support for biometrics, better handling of mobile devices, and more detailed transaction data. | "2.2.0" |

ddds_eci | string | Electronic Commerce Indicator: A payment system-specific value provided by the ACS to indicate the outcome of the cardholder authentication attempt. This code is returned by the issuing banks and credit card-specific networks to notify a merchant about the authentication of the cardholder and the status of the card holder's issuing bank under the 3D Secure Authentication program. This value is represented by 2 characters. For Visa ECI values, check out 5.1 Electronic Commerce Indicator (ECI). For Mastercard ECI values, see E-Commerce Commerce Indicator. | "05" |

ddds_dstransid | string | A universally unique transaction identifier assigned by the DS to distinguish a single transaction. It is 36 characters long. | "d65e93c3-35ab-41ba-b307-767bfc19eae3" |

ddds_authenticationvalue | string | Payment System- specific value provided as part of the ACS registration for each supported DS. It is 28 characters long. | "ANtRo07IKYx4LTvmCzK7IFaMrlY=" |

ddds_status | string | 3DS status from 3rd party. For Mastercard 3DS status values, check out Mastercard Identity Check Program Guide under Whitelisting Status Response. For Visa 3DS status values, check out Common Visa 3DS Status Values. | "Y" |

Common Visa 3DS Status Codes

For more information, the Merchant/Acquirer Implementation Quick Reference for 3-D Secure 2.0 offers guidance tailored for merchants and acquirers.

| Value | Description |

|---|---|

Y | Authentication Successful. The cardholder has been successfully authenticated by the issuer. |

N | Authentication Failed. The cardholder failed or canceled the authentication. |

A | Attempts Processing Performed. Authentication could not be completed, but a proof of attempted authentication is provided. |

U | Authentication Could Not Be Performed. Technical or other problems prevented authentication. |

C | Challenge Required. Additional authentication is needed to verify the cardholder. |

R | Authentication Rejected. The issuer rejected the authentication request. |

3D Secure Implementation Options

The authenticated 3D Secure data can be provided in a QSAPI transaction in the following three ways:

- iFrame: Using the

eTokengenerated and encrypted via the iFrame Component with the built-in Bluefin PCI-compliant environment in place. This token encrypts and includes all of theddds_*data parameters and the sensitive credit/pan data. - Hosted Payment Forms: Enabling 3D Secure for Hosted Payment Forms incorporates the 3D Secure feature per form. The form applies the 3DS data to a QSAPI transaction and processes it. Compared to the encrypted iFrame

eToken, after the Bluefin 3DS workflow is completed, the form uses the raw card data and the 3DS data directly in a QSAPI transaction. This variant is also PCI-compliant. - Server-Side Integration: This approach uses the raw credit/pan data and manually includes the 3D Secure data returned from the endpoints via Bluefin 3DS Solution. For the comprehensive guide of how to integration with our 3DS endpoints, please refer to Server-Side 3DS Integration. This approach is considered to be server-side(server-to-server) 3DS integration. However, apart from Hosted Payment Forms, we recommend this approach only for large ISVs with their own PCI-compliant environment. For this implementation variant, please consult the Bluefin Technical Support first.

- Bluefin 3DS SDK: This approach combines using the Bluefin 3DS SDK, processing a QSAPI transaction with the raw credit/pan data. The SDK manages communication with the Bluefin 3DS Solution, streamlining the process for merchants by providing a ready-to-use tool for immediate integration. Similar to the Server-Side Integration, this use case is usually common for large ISVs with their own PCI-compliant environment where they can directly integrate with Bluefin 3DS and make use of the 3DS SDK. Given that the SDK communicates with the 3DS endpoints from the browser, this approach is considered to be client-side 3DS integration.

For more detailed instructions, select how you want to integrate:

iFrame

Note

Before configuring 3D Secure settings for

iFrame, make sure to satisfy the Requirements first.

Before reading this implementation option, consider reading over iFrame.

3D Secure on iFrame (Configuration & Set up)

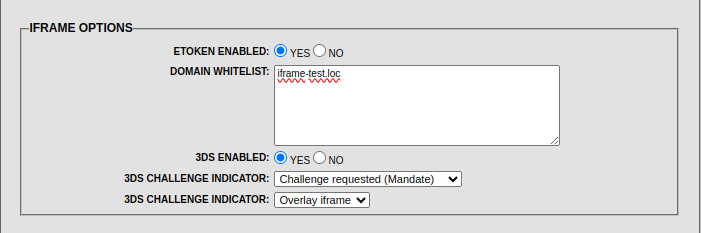

3D Secure settings can be configured from the PayConex™ Account Settings page under the iFrame options.

PayConex™ Portal iFrame Options

Note

If you have trouble with setting up the Domain Whitelist, refer to iFrame Implementation.

eToken Enabled

| Enabled | Description |

|---|---|

| Yes | Encrypts the raw credit card data and all the ddds_* data parameters, and returns the token in the JavaScript object in the browser. This token can then be used in a payment request. |

| No | Does not return the eToken for reuse. |

The dropdown selections include:

3DS Challenge Indicator

| Option | Description |

|---|---|

No Preference | We suggest our merchants leave preference blank with this option. This option is the most frictionless. |

No Challenge requested | Challenge is never presented to the end-user. |

Challenge requested | Inform the issuing bank that the challenge is presented to your end-users. |

Challenge requested mandated | This option dictates that a challenge must be presented to the end-users. |

3DS Challenge Display Option

| Option | Description |

|---|---|

Overlay iFrame | If the transaction is challenged the bank's dialog will overlay the Payment iFrame. This option is recommended when the Payment iFrame takes up a lot of screen real estate. |

Pop-up Window | If the transaction is challenged the bank's dialog will appear in a popup window. This option is suggested if the area given to the Payment iFrame is relatively small. |

3D Secure & the iFrame SDK

To support 3D Secure, the encrypt function on the Payment iframe can consume a 3D Secure data object containing transaction meta-data. However, this data is not stored in the PayConex™ system and is exclusively used for 3DS Authentication. If a merchant wishes to provide it as transaction meta-data, the same customer-information fields can be included in a QSAPI transaction request.

While the object has over 20 fields, the minimum fields required for most card brands are amount and cardHolderName. However, Amex requires the additional fields shipIndicator, deliveryTimeFrame, and reorderItemsInd.

These fields are the following:

iFrame DDDS Parameters

| Parameter | Required | Type | Description | Example |

|---|---|---|---|---|

amount | true | string | Transaction total dollar amount. | "10" |

cardHolderName | true | string | First name and Last Name of credit card holder. | "John Smith" |

email | false | string | Card holder's email address. | "[email protected]" |

shipIndicator | false | string | Shipping method used to deliver goods. | See shipIndicator. |

deliveryTimeFrame | false | string | The time for the goods to be delivered. | See deliveryTimeFrame. |

reorderItemsInd | false | string | Indicates whether the order is new or was ordered before. | See reorderItemsInd. |

currency | false | string | ISO 4217 three-digit currency code. Default is 840 (USD). | "840" |

shippingLine1 | false | string | First line of shipping street address. | "2 Main St" |

shippingLine2 | false | string | Second line of shipping street address. | "Downtown" |

shippingLine3 | false | string | Third line of shipping street address. | "Near Central Park Entrance" |

shippingPostCode | false | string | Zip Code / Postal Code of shipping address | "90210" |

shippingCity | false | string | City of shipping address. | "Atlanta" |

shippingState | false | string | State of shipping address. Values accepted are the country subdivision code defined in ISO 3166-2. e.g. GA for Georgia. | "AL" |

shippingCountry | false | string | Country of shipping address. Values accepted are ISO 3166-1 three-digit country codes. e.g. 840 for the United States. | "840" |

billingLine1 | false | string | First line of cardholder street address. | "123 N. Main St" |

billingLine2 | false | string | Second line of cardholder street address. | "Downtown" |

billingLine3 | false | string | Third line of cardholder street address. | "Near Central Park Entrance" |

billingPostCode | false | string | Zip Code / Postal Code | "90210" |

billingCity | false | string | City of cardholder address | "Atlanta" |

billingState | false | string | State of cardholder address. Values accepted are the country subdivision code defined in ISO 3166-2. e.g. GA for Georgia. | "AL" |

billingCountry | false | string | Country of cardholder address. Values accepted are ISO 3166-1 three-digit country codes. e.g. 840 for the United States. | "840" |

clientTransactionId | false | string | Optional ID for merchant to correlate with the 3DS transaction. | "asdf1234" |

shipIndicator

shipIndicator| Value | Description |

|---|---|

01 | Ship to cardholder’s billing address. |

02 | Ship to another verified address on file with merchant. |

03 | Ship to address that is different than the cardholder's billing address. |

04 | Ship to Store / Pick-up at local store (Store address shall be populated in shipping address. fields). |

05 | Digital goods (includes online services, electronic gift cards and redemption codes). |

06 | Travel and Event tickets, not shipped. |

07 | Other (for example, Gaming, digital services not shipped, emedia subscriptions, etc.). |

deliveryTimeFrame

deliveryTimeFrame| Value | Description |

|---|---|

01 | Electronic Delivery. |

02 | Same day shipping. |

03 | Overnight shipping. |

04 | Two-day or more shipping. |

reorderItemsInd

reorderItemsInd| Value | Description |

|---|---|

01 | First time ordered. |

02 | Reordered. |

Sample 3D Secure Data

{

"amount" : "300",

"cardHolderName" : "John Smith",

"email" : "[email protected]",

"shipIndicator" : "01",

"deliveryTimeFrame" : "02",

"reorderItemsInd" : "01",

"currency" : "840",

"shippingLine1" : "2 Main St",

"shippingLine2" : "Downtown",

"shippingLine3" : "",

"shippingPostCode" : "90210",

"shippingCity" : "Atlanta",

"shippingState" : "GA",

"shippingCountry" : "840",

"billingLine1" : "2 Main St",

"billingLine2" : "Downtown",

"billingLine3" : "",

"billingPostCode" : "90210",

"billingCity" : "Atlanta",

"billingState" : "GA",

"billingCountry" : "840",

"clientTransactionId" : "asdf1234"

}

Sample encrypt call

The following example calls the encrypt function with the additional 3DS data.

// Called when user clicks submit on parent page

paymentiFrame.encrypt({

ddds_params: {

amount : "300", // three hundred dollars

cardHolderName : "John Smith",

shipIndicator : "06", // Travel and Event tickets, not shipped

deliveryTimeFrame : "01", // Electronic Delivery

reorderItemsInd : "01", // First time ordered

}})

.success(function (res) {

console.log("id " + res.id + " token=>" + res.eToken );

})

.failure(function (err) {

console.log("Error: " + err.id + " -> " + JSON.stringify(err, null, 4));

})

.invalidInput(function (data) {

for (var i = 0; i < data.invalidInputs.length; i++) {

console.log("InvalidInput: " + data.invalidInputs[i].code + ": " + data.invalidInputs[i].field + " -> " + data.invalidInputs[i].message);

}

});

If the success callback get triggered, it returns the following object:

{

"id": "22bd0d27-9b69-5f31-dcf6-bb11c882fb0b",

"eToken": "DBTFrkuDZpNUmFc-edkeYQCuJihCWtvLW9PGyH5qsd7VZGVMpDTZQXnumV758U_QsCeuEhXxWTTTd7zk0wEnyvFih4DCMlbZ4T_vvzPBrbve3y8ax_cGT5VKIHrUjpr8tbC4YmJzGg6FAzjA5x9y8XzIw9CBMbQ5NZvEIZzT03ni_gbZSjxeorUCRBRnmnTPgQ4LJiil5sbgDbAPYtlcg9xo0eqV6Yp6",

"masked": {

"number": "4***********9990",

"expy": "1225",

"cvv": "***"

},

"ddds_result": {

"error": null,

"ddds_version": "2.2.0",

"ddds_eci": "05",

"ddds_dstransid": "2abe7b65-45cd-4a58-bcd3-8b10b8f8f50e",

"ddds_authenticationvalue": "ji+A0S72pd/RFOrr1fwCKXKqDno=",

"ddds_status": "Y",

"ddds_attempted": true,

"ddds_challenged": false,

"card_brand": "VISA"

},

"antiFraud": {

"device_trans_id": "e32df64a8ad58db99799c81019ab4352add6"

}

}

Enabling eToken in the Portal settings includes the token in the object above, eliminating the need for the ddds_result data, as these are embedded within the encrypted token itself.

The

antiFraudobject is included with the Anti-Scoring feature enabled - see Requirements.

QSAPI Transaction

Finally, we can use the eToken in the Bluefin's PayConex™ API (QSAPI) request.

Note

When there is the

eTokenparameter in a QSAPI request, the token overrides the values set for thecard_number,card_expiration, andcard_verificationparameters. For further details on the other supported QSAPI parameters, please refer to the QSAPI Request Format.

curl "https://secure.payconex.net/api/qsapi/3.8/" \

-X POST \

--header "Content-Type: application/x-www-form-urlencoded" \

--header "Cache-Control: no-cache" \

-d response_format=JSON \

-d account_id=<replace_account_id> \

-d api_accesskey=<place_api_accesskey_here> \

-d tender_type=CARD \

-d transaction_type=SALE \

-d transaction_amount=99.00 \ # Transaction Total

-d first_name=Joseph \

-d etoken=<place_token_here> \ # eToken from iFrame encrypt call

-d custom_id=f04f4fee-91a7-4329-9d65-c228dbd8319a # custom_id for transaction tracing purposes

Hosted Payment Forms

Note

Before configuring 3D Secure settings for

Hosted Payment Forms, make sure to satisfy the Requirements first.

Before reading this implementation option, consider revisiting Hosted Payment Forms.

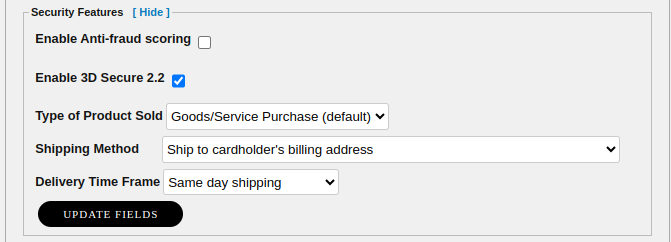

Enabling on the Hosted Payment Forms

The user must turn on Enable 3D Secure 2.2 Authentication per Hosted Form through the Tools -> Hosted Payment Forms under Security Features. To see this option, of course make sure that the Payment Options check Credit & Debit Card.

Hosted Payment Forms Security Features

Note

The Anti-fraud scoring is also enabled per Hosted Form.

As far as the challenge display option, it is usually none in order to keep the workflow as frictionless as possible. However, this option can be featured as either a pop-up or an overlay. To enable this functionality, please contact Bluefin Technical Support.

The dropdown selections consist of:

Shipping Method

| Method |

|---|

| Ship to cardholder's billing address |

| Digital goods (online services, electronic gift cards and redemption codes) |

| Travel and Event tickets, not shipped |

| Other (gaming, not shipped digital services, e-media subscriptions, etc.) |

Delivery Time Frame

| Time Frame |

|---|

| Same day shipping |

| Overnight shipping |

| Two-day or more shipping |

Upon landing on the Payment page, 3D Secure authentication happens in the background within milliseconds. An end-user enters the card payment information, and upon clicking Process Payment 3D Secure authentication takes place. After the 3D Secure authentication is successful, the 3D Secure data results are used in a transaction request in the same way as the QSAPI Transaction with 3DS Data.

Agents/Merchants can check the transaction meta-data to see if the transaction was 3D-authenticated. To check that out in action, see Getting 3DS Transaction Data and Create Report.

QSAPI Transaction with 3DS Data

In addition to the regular parameters you provide in your payment request, we recommend that you provide all available information to increase the likelihood of achieving a frictionless flow and a higher authorization rate.

Some of these objects might be mandatory for the issuer and the card scheme, and not providing them in your payment request might result in a failed authentication.

curl --location --request POST 'https://secure.payconex.net/api/qsapi/3.8' \

--header 'Accept: application/json' \

--header 'Content-Type: application/x-www-form-urlencoded' \

--data-urlencode 'account_id=180000005404' \

--data-urlencode 'api_accesskey=7c5849b64dc5639d6bbac7ee44b385be' \

--data-urlencode 'response_format=JSON' \

--data-urlencode 'transaction_type=SALE' \

--data-urlencode 'tender_type=CARD' \

--data-urlencode 'card_verification=123' \

--data-urlencode 'card_expiration=1222' \

--data-urlencode 'transaction_amount=55' \

--data-urlencode 'dental_amount=50.85' \

--data-urlencode 'card_number=4264280001234559' \

# 3DS-Authenticated Parameters

--data-urlencode 'ddds_dstransid=d65e93c3-35ab-41ba-b307-767bfc19eae3' \

--data-urlencode 'ddds_authenticationvalue=ANtRo07IKYx4LTvmCzK7IFaMrlY=' \

--data-urlencode 'ddds_eci=05' \

--data-urlencode 'ddds_status=Y' \

--data-urlencode 'ddds_version=2.2.0'

ddds_dstransid and Amex cards

For Amex cards, usually a separate

amexDsTransIdis used. Its value has to be passed on in theddds_dstransidfield.

Note

When a 3DS authentication fails, anti-fraud scoring becomes a factor in deciding whether the transaction should proceed. Anti-fraud scoring can serve as a secondary line of defense when 3DS fails.

Fraud Scoring is a feature on its own and it does not need to be used with 3D Secure. For more, refer to Fraud Scoring.

For Direct API Integration, the

device_trans_idparameter is included in the transaction request above.

Reporting

Agents/Merchants have the ability to run reports with transactions that were 3DS protected both via the Portal and RSAPI.

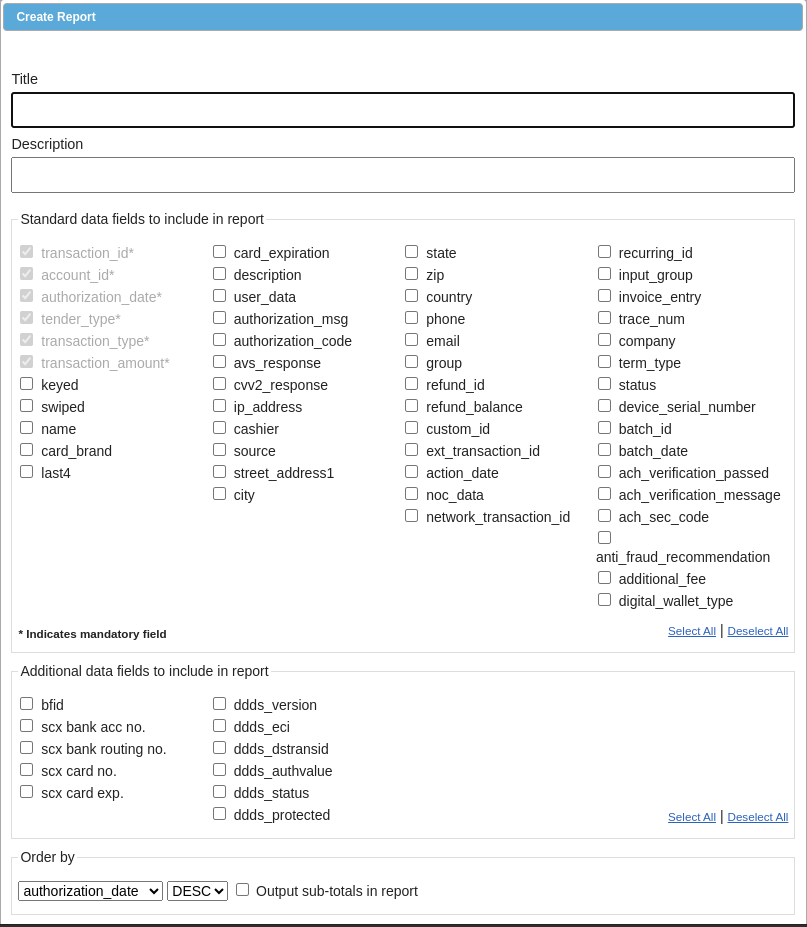

Create Report

PayConex™ Custom Reports gives our merchants the flexibility to add 3D Secure data elements so that report is at their fingertips.

In the Portal, this option can be found in the reports tab under Custom Reports.

PayConex™ Portal Create Report

These are under

Additional data fields to include in reportto include the 3DS Data Parameters.

Getting 3DS Transaction Data

When getting a transaction meta-data to verify if a transaction was 3DS-authenticated, it is crucial to include these fields as they are not included by default unless we view the complete transaction in the PayConex™ Portal.

Request

curl --request POST \

--url https://cert.payconex.net/api/rsapi/3.8 \

--data account_id=<replace_account_id> \

--data api_accesskey=<place_api_accesskey_here> \

--data response_format=JSON \

--data transaction_id=000000039466 \

--data include_fields=ddds_version,ddds_eci,ddds_dstransid,ddds_authenticationvalue,ddds_status,ddds_protected

Response

{

"api": "RSAPI",

"version": "3.8",

"count": 1,

"transactions": [

{

"transaction_id": "000000039466",

"account_id": "220615031547",

"authorization_date": "2024-12-17 08:36:05",

"tender_type": "CARD",

"transaction_type": "SALE",

"transaction_amount": 1,

"ddds_version": "2.2.0",

"ddds_eci": "05",

"ddds_dstransid": "2abe7b65-45cd-4a58-bcd3-8b10b8f8f50e", // ID issued by Directory Server

"ddds_authenticationvalue": "ji+A0S72pd/RFOrr1fwCKXKqDno=",

"ddds_status": "Y",

"ddds_protected": "Yes"

}

]

}

For the description of all

ddds_*parameters, see 3DS Data Parameters.

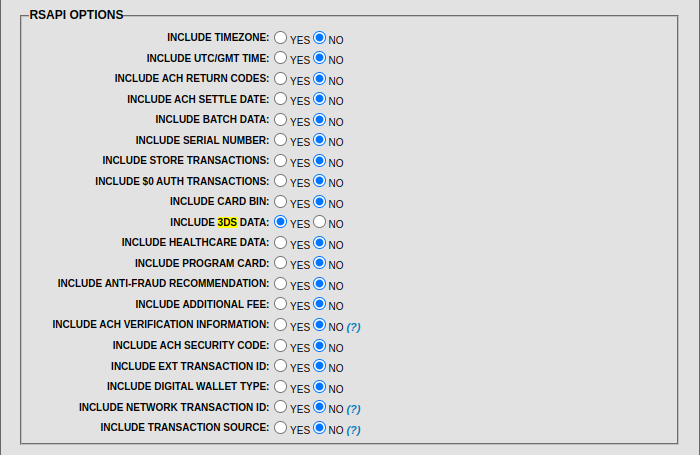

Another alternative is to enable the inclusion of 3DS data under RSAPI Options but note that it is then added for each transaction meta-data response.

PayConex™ Portal RSAPI Options

Test Card Numbers

The following set of test card numbers can be used to evaluate the different ECI values and 3DS statuses. Where the status and ECI are a ? the card number is triggering a challenge, the results will depend on the option selected in the dropdown on the challenge dialog set in the iFrame options.

Note

These cards are intended solely for testing purposes and should only be used in the Testing/Certification environment. They allow merchants and developers to simulate real-life scenarios to gain a better understanding of how 3D Secure operates.

3D Secure 2.0 Test Cards

| Card Number | Network | Prompt | ECI | Status/Success |

|---|---|---|---|---|

4124 9399 9999 9990 | Visa | N | 5 | Y |

4485 6600 0000 0007 | Visa | N | 7 | N |

4485 6666 6666 6668 | Visa | Y | ? | ? - Depends on the challenge completion |

4160 2944 4444 4449 | Visa | - | - | Error: Card Not Enrolled |

5406 0044 4444 4443 | Mastercard | N | 2 | Y |

5415 2444 4444 4444 | Mastercard | N | 0 | N |

5472 0655 5555 5557 | Mastercard | Y | ? | ? - Depends on the challenge completion |

6011 9933 3333 3334 | Discover | N | 5 | Y |

6011 4023 4444 4445 | Discover | N | 7 | N |

6011 9922 2222 2228 | Discover | Y | ? | ? - Depends on the challenge completion |

3700 009999 99990 | AmEx | N | 5 | Y |

3700 002222 22228 | AmEx | N | 7 | N |

3400 001111 11117 | AmEx | Y | ? | ? - Depends on the challenge completion |

Updated 7 months ago